Start your

trading journey on Spin

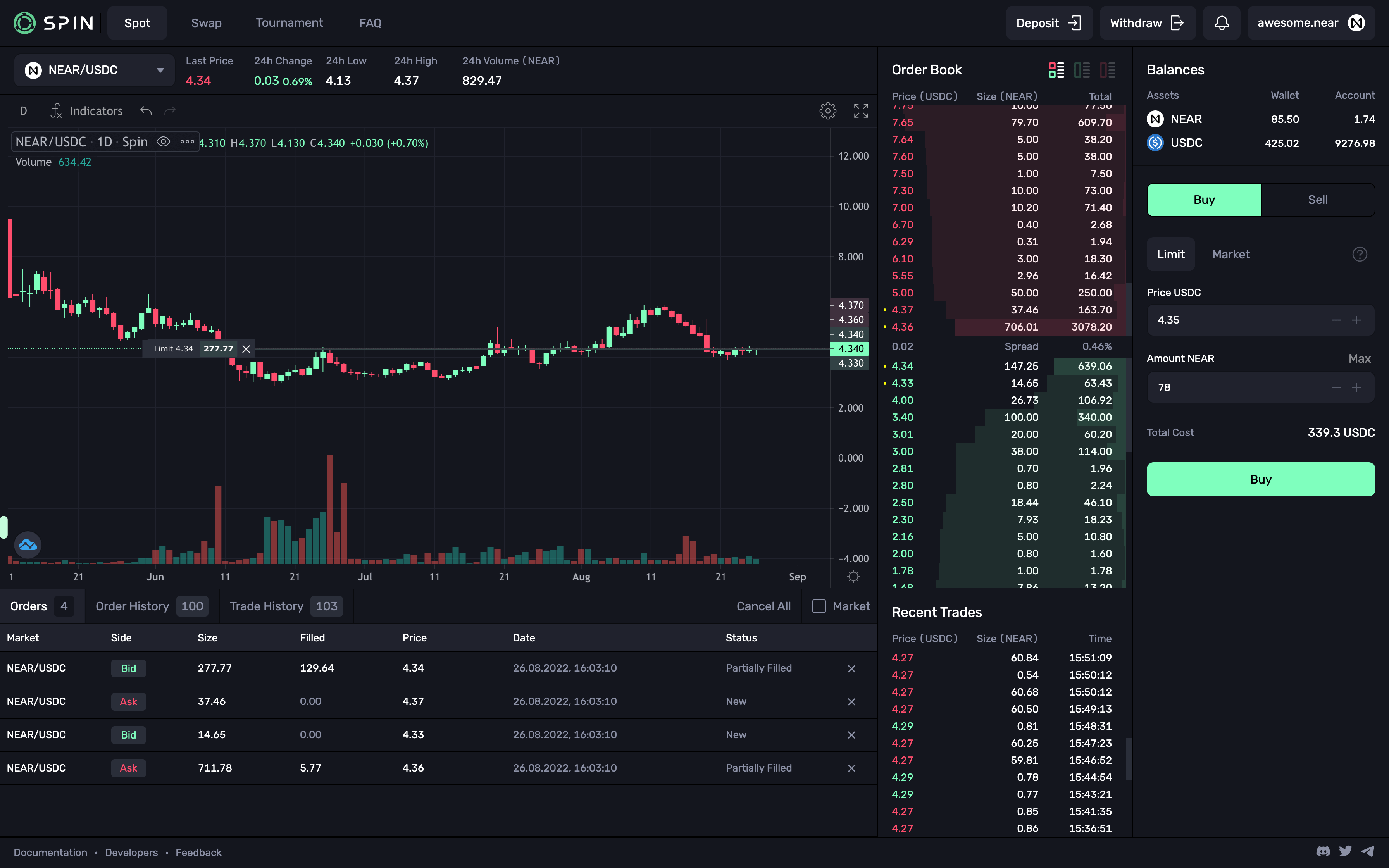

New level of DEX trading

No counterparty risks: connect your NEAR wallet to Spin, make a deposit and start tradingEasy trading history tracking

Analyze the trading data easily by switching between open orders, order history, and trading history tabsMultiple order types

Use the full range of order types to implement your trading strategyOn-chain order book

Enjoy deep liquidity with minimum price slippage and accurate pricingHandy UX/UI

Customize the charts and see open orders levels right in the terminalExtremely low trading fees

Choose between a wide range of markets with low taker fees and 50% maker rebates